Think Like a Millionaire: 5 Proven Financial Habits for Long-Term Wealth

Introduction: Wealth is built by the mind, not just by earning money.

Everyone wants to be rich, but very few people adopt the “millionaire-like thinking”.

1. Pay Yourself First

What do most people do? They spend first, then save what’s left.

Millionaires do the opposite.They first save and invest, and then spend the remaining money. Example: Warren Buffett’s business partner **Charlie Munger** used to save 30-40% of his meagre earnings. This habit made him a billionaire.What you should do:Set up an auto transfer to your savings or SIP account every month immediately after your salary.

2. Regular investment - Time matters, not timing

Millionaires invest every month - whether the market is up or down.

They know:

To become rich, you have to work very hard first because no one can become rich through easy means. If you also do not waste your time and learn some skills and work hard, then you will definitely be successful.

Time in the market is better than timing the market.

Example:

If you had invested $500 every month in S&P 500 from 2000 to 2020, you would have **$2.5 lakh dollars (₹2 crore+ INR)** — and this is when you have also faced the crash of 2008.

How to start: SIP, Index Funds, Mutual Funds — start with ₹500 or ₹1000/month.

3. Invest in learning, not in showing off

Real rich people spend time **learning**, not scrolling social media. If you spend your time learning something now, you will definitely achieve success.

They read books, do courses, and constantly upgrade themselves.

Warren Buffet reads 500 pages every day.

Elon Musk taught himself rocket science from books — without a degree!

Best books to read:**

The Millionaire Next Door

Rich Dad Poor Dad

The Psychology of Money

Atomic Habits

Remember:

The more you know, the more you earn.

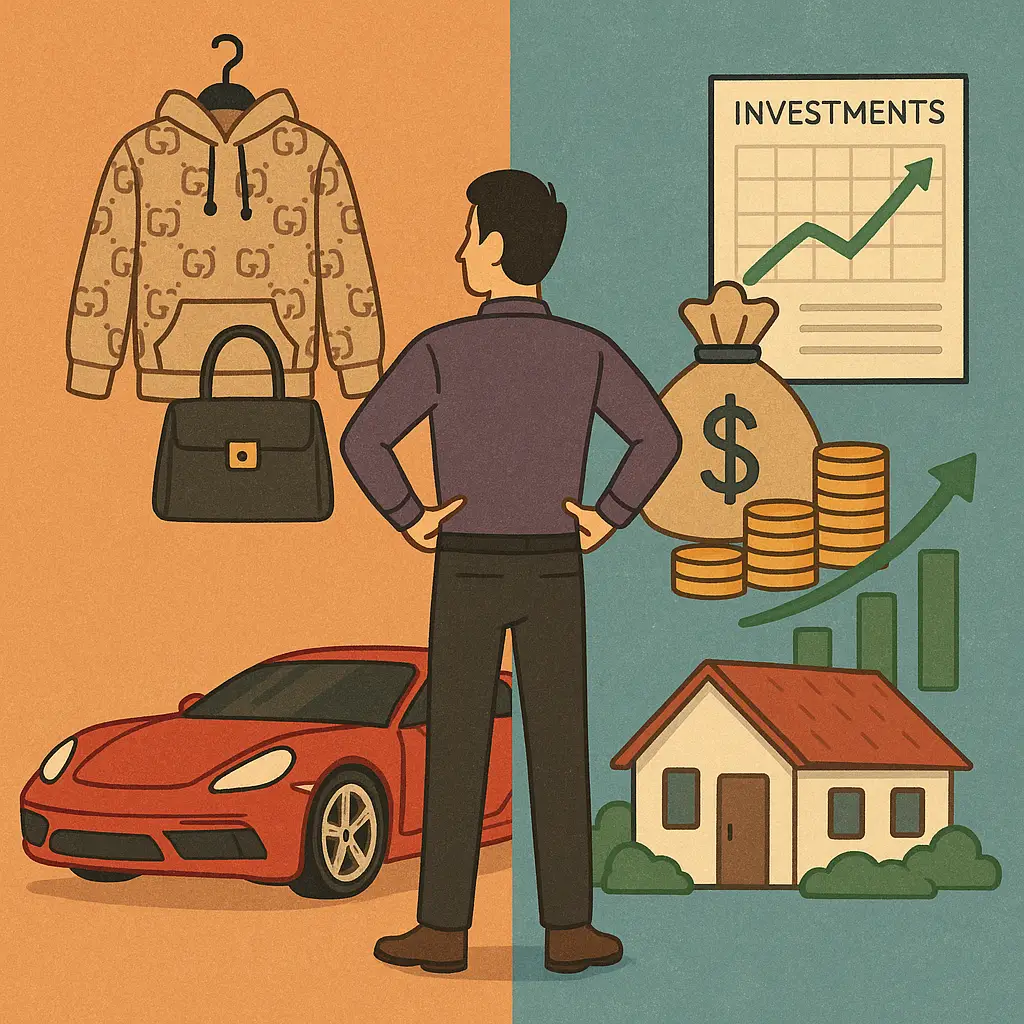

4. Increase investment before increasing lifestyle

Rich people do not spend on expensive mobiles, cars, or branded things when their income increases.

They earn more and invest more.

Example:

Mark Zuckerberg still wears a simple grey T-shirt.

Narayan Murthy (Infosys) still travels in economy class.

Learning:

Wealth is not created by showing off. The more simple you live, the more you will be able to save.

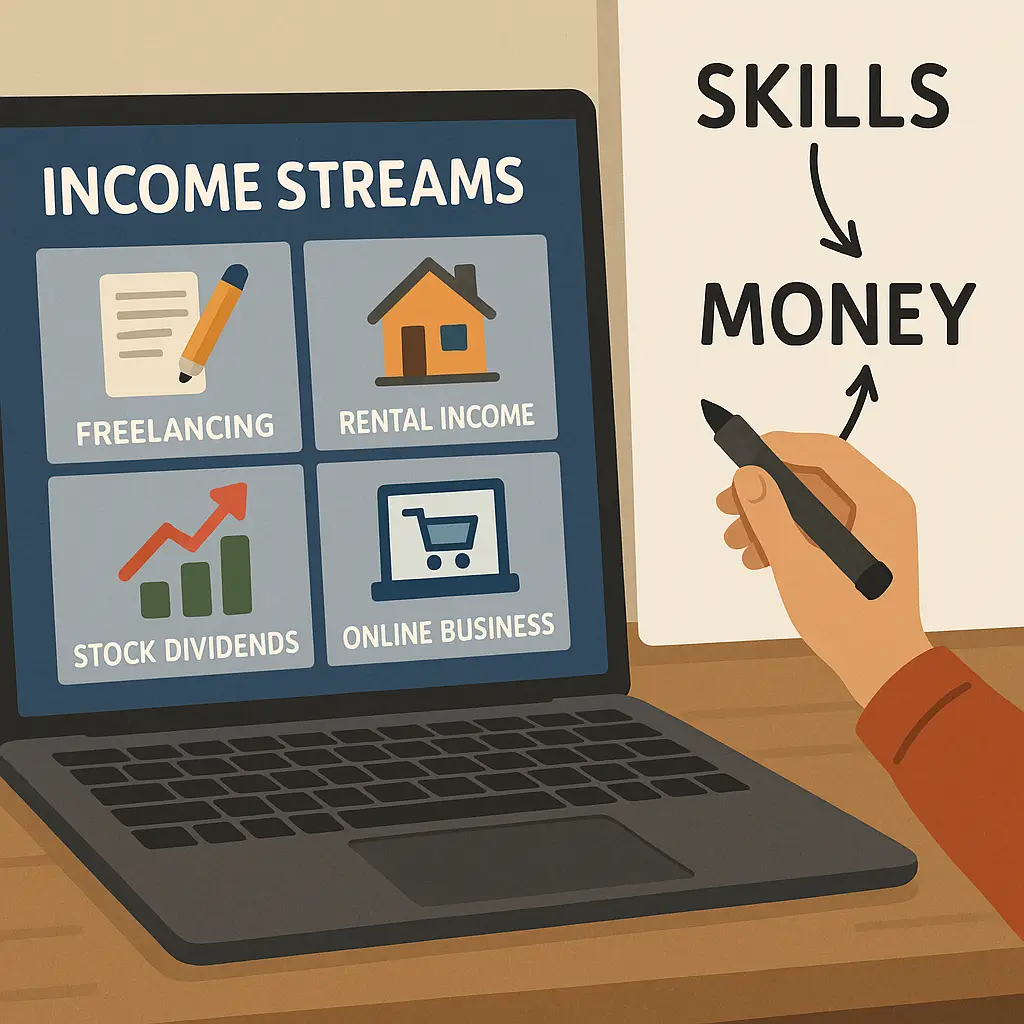

5. They do not run after money – they put money behind them

Millionaires do not depend only on salary.

They create **multiple income sources** — like:

* Rental Income

*Stock Dividends

* Online Businesses

* Freelancing or Courses

**Example:**

A common man who does a 9-5 job, depends on just 1 income source.

But millionaires have 3-4 sources, from which they earn passive income.

## Conclusion: Wealth starts with thinking

By adopting these 5 habits, you will not only make money —

You will also adopt a rich thinking and lifestyle.**

Whether you are in India or USA —

Habits are the ones that create wealth.